“InSECURE”: A Solution to Maintain Lifetime Payouts from an IRA Left to Loved Ones

Introduction

The SECURE Act, which was signed into law on December 20, 2019, significantly changes the rules that apply to distributions from IRAs, 401(k)s, and similar accounts after the passing of a plan participant. The new law eliminates most lifetime stretch distributions and requires most beneficiaries to withdraw the full account balance within ten years.

The economic loss to these beneficiaries is significant because the average age most people inherit IRAs is between ages 50-55 and they are already at their peak income-earning years. Therefore they'd ideally “stretch” the inherited IRA payments over their lives, but they no longer can do so.

Naming a charitable remainder trust may increase the tax savings for beneficiaries compared to using the new ten-year rule for distributions. Individuals who leave a surviving spouse have most, but not all, of the same “stretch IRA” options they had before 2020. The surviving spouse is still able to roll the IRA over to his or her own IRA and not take distributions until age 72.

Eligible Designated Beneficiaries

In addition to the above, there is still much to consider because, after the death of the surviving spouse, the payout to or for children or other beneficiaries will typically have to be distributed within ten years for “designated beneficiaries” if things are set up correctly, or within five years if not done correctly. There are certain recipients who can still stretch the inherited retirement plan over their lifetimes. The exceptions to the ten-year rule include the following:

- Individuals who are less than ten years younger than the deceased participant.

- A disabled or chronically ill individual.

- A child until she reaches the age of majority.

- A surviving spouse.

No Creditor Protection When IRA is Left Directly to Loved Ones

In 2014 the Supreme Court's decision of Clark v. Rameker acknowledged that while the bankruptcy code is intended to protect the retirement accounts of debtors, it is not meant to protect the inherited IRAs. Because inherited IRAs do not allow for contributions, or do not have early withdrawal penalties associated with them, the unanimous Supreme Court decision acknowledged that inherited IRAs are “freely consumable” by the beneficiary, and thus are available to the creditors of the beneficiary as well.

This Supreme Court decision will now leave those who are expecting to have creditor protection exposed. From a proactive planning perspective, the Clark decision made it more appealing to leave inherited retirement accounts to loved ones in trust, than directly. The challenge now in 2020 is that the SECURE Act reduced the creditor protection that traditional trusts have offered retirement assets. (More on “conduit” trusts below).

Traditional Trust Planning with Retirement Assets

Because retirement assets are typically the largest asset in an individual's estate, special planning is required to ensure the beneficiaries inherit these assets in the most optimal way, customized for each beneficiary. Before 2020, retirement assets could be payable to a “see-through” trust. These IRA trusts are known as either “conduit” trusts or “accumulation” (or discretionary) trusts.

Under the old rules, if the IRA trust qualified as a see-through trust, the trust beneficiaries were treated as if they were named directly, and the stretch payout was permitted. With a conduit trust, RMDs are paid from the inherited IRA to the trust and distributed to the trust beneficiaries annually. With a conduit trust, the beneficiaries paid tax on the RMDs at the beneficiary's own tax rate.

With an accumulation trust, the trustee has the discretion to decide whether to pay out the RMDs immediately to the trust beneficiaries or instead retain the assets in the trust to preserve the funds. Unfortunately, when the RMD funds are kept in the accumulation trust, they are taxed to the trust at the high trust tax rates, instead of being taxed to the beneficiaries directly.

In 2020 and beyond, the problem with the conduit trust is there are zero RMDs and at the end of the ten years, the entire balance in the inherited IRA would be paid out to the beneficiaries. This results in no funds remaining protected in the trust after the ten years and leaves recipients with a mega tax bill.

If an accumulation trust is a beneficiary, then again, all of the inherited IRA funds would have to be paid to the trust by the end of the ten years. Since this is an accumulation trust, the trustee does not have to pay out all of the funds to the trust beneficiaries, so the funds could remain in the trust and be protected, but at a cost. After those 10 years, the entire trust would be taxed at federal trust tax rates, which are taxed at 37% over just $12,950 of income in 2020.

Testamentary Charitable Remainder Trusts

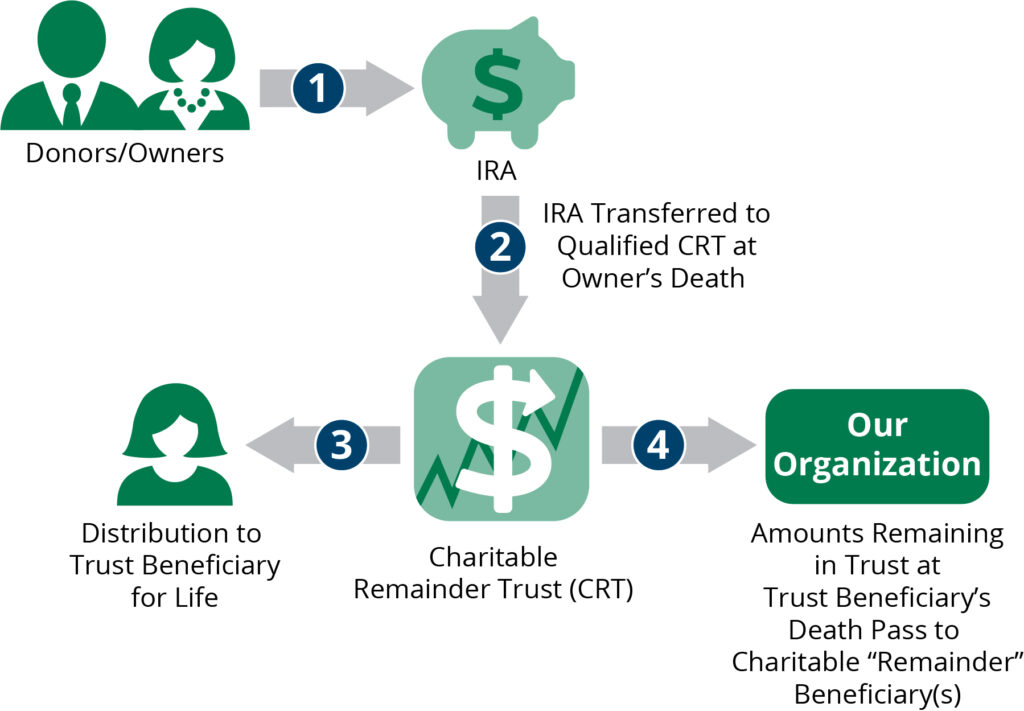

For donors who wish to provide for charity with an estate gift and establish a reliable income stream to one or more heirs, using retirement plan assets to fund a testamentary charitable remainder trust (TCRT) can be an effective way to accomplish both goals. In a series of positive private letter rulings, the IRS determined this transfer would not trigger federal income tax on the entire balance.[1] Instead the income tax is applied only as this income is distributed individually to the income beneficiaries of the CRT.

At the passing of the IRA owner, all the money leaves the IRA to the CRT and no income tax is paid, and now the charity is going to receive the IRA but before it does, the donors loved ones will get income for the rest of their life based on the entire 100% of the value of the IRA instead of rather than only 60% after taxes are paid.

Example

In 2020 Vivian Smith, age 80 is revising her estate plans for her son Tom, age 45. Unfortunately, Tom is going through a divorce at this time and has been between jobs. Vivian's largest asset is her IRA and named her son Tom as the IRA's only designated beneficiary. In 2025, at the time of Vivian's death, Tom is age 50. The value of Tom's inherited IRA is $500,000. Let's look at three potential outcomes that Vivian can control as she reviews her estate plans in 2020.

Assume first that Tom is not the most financially sophisticated and In 2025 immediately withdraws the IRA account and pays income taxes at an effective rate of, say, 45% (federal and state combined), his net after-tax value is $275,000. Even worse, imagine that Tom has serious debts From his divorce and his creditors are able to take the entire retirement plan before he receives any benefit.

Second, assume the Tom clears up his creditor problems on his own (By 2035) and is also wise enough to maximize his deferral so he instead waits ten years and then withdraws the entire account. Also assuming that the rate of investment return inside the inherited IRA is 7% and that Toms's after-tax rate of return is 3.9%, his after-tax net present value is $370,771, which is certainly an improvement of $95,771 compared to the first outcome.

Finally, assume that Back in 2020 Vivian back establishes and names as the IRA's beneficiary a testamentary charitable remainder unitrust (CRUT), paying Tom 5% of the trust's value each year (5% unitrust) for life, assuming that the CRUT earns an annual return on investment of 7% and makes payments to Tom at the end of each year.

Vivian decides that she wants the trustee to have the “sprinkling” authority to allocate the income between the beneficiaries. So she makes both Tom and her church income beneficiaries. If Tom makes poor life choices the trustee can decide to allocate income to the church instead of Tom. However if Tom remains employed, and passing random drug tests, Tom can expect to continue to get the full 5% of the payments each year of his life.[2]

Tom lives to age 87, and the present value of his income payments from the time, when the CRUT is funded, is $668,811. This result is a significant improvement of $393,811 over the first outcome if Tom takes an immediate lump sum. Additionally, the present value of the charity's remainder interest is $81,132 (7% discount rate assumed because neither the CRUT nor the charity pays income taxes).

Conclusion

For those who are willing to “pledge” part of their retirement assets to charity, they can still provide the “stretch IRA” experience for their adult children and also leave a charitable legacy. For affluent families large enough to owe federal estate tax, a transfer of retirement plan assets into a charitable remainder trust is eligible for an estate tax deduction in addition to the income tax deferral for beneficiaries to “stretch” the payments over their lifetimes.

When someone has designated a trust as the beneficiary of their retirement accounts, they should review the drafting of that trust with an estate planning attorney to understand the implications of the SECURE Act. With careful attention by your estate planning attorney, a trust can be designed to hold an IRA that need not distribute all IRA withdrawals within 10 years and may instead accumulate those withdrawals (but at higher trust income tax rates). For those with some charitable intent, they can establish a trust that can pay income for the lifetime of their children, or other loved ones, at their own (likely lower) income tax rates.

[1]See PLR 9237020 and PLR 9253038 which address IRA's and 401k assets

[2]This clause should not disqualify the trust [IRC §674(c), Rev. Rul. 77-73, PLR 9052038], although naming a charity as an income beneficiary does not increase the donor's

income tax charitable deduction Reg. §1.664-3(d).