A life income gift is an arrangement that provides you or others with income and leaves a gift for charity in the future. Creating a charitable remainder trust, charitable gift annuity, or other life income gift at [our organization] is a great way to support the university while also taking care of yourself or loved ones. In addition, a life income gift may entitle you to tax savings. Making a future gift to [our organization] can give you the satisfaction of knowing that your legacy will support generations of outstanding students and faculty.

How Does It Work?

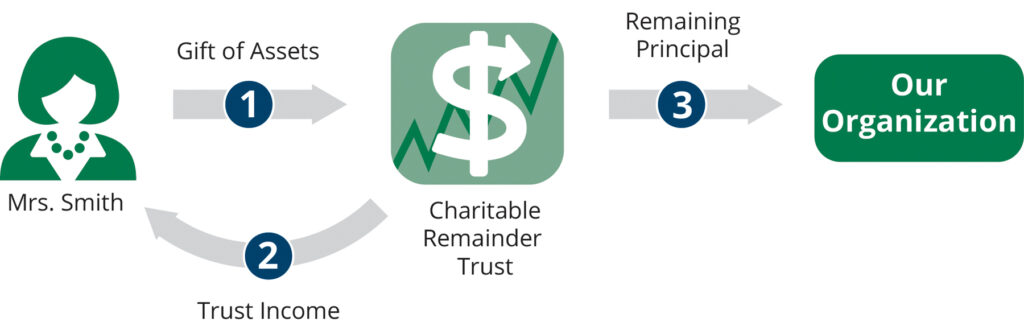

- You give assets—such as securities, real estate, or cash—to fund a life income gift.

- You (or your loved ones) receive an income stream. You may also be entitled to tax benefits, such as an income tax deduction and savings on capital gains tax.

- When your life income gift matures, the remainder will be used at [our organization] to support the purposes you have chosen.

CHOOSING THE RIGHT PLANNED GIFT DEPENDS ON YOUR CIRCUMSTANCES

and financial goals. There are several kinds of life income gifts available at [our organization]:

Charitable Gift Annuity: In exchange for an outright gift, [our organization] agrees by contract to pay a fixed dollar amount each year to you and another beneficiary for life. Donors can designate the gift to [our organization] for a specific purpose.

Charitable Remainder Annuity Trust: You establish a trust from which you and other beneficiaries receive annual payments of a fixed dollar amount for life and a term of years, after which the remainder of the trust assets passes to [our organization] for the purposes you designate.

Charitable Remainder Unitrust: You establish a trust from which you and other beneficiaries receive variable annual payments for life and a term of years. At the end of the term, the remainder of the trust assets is distributed to [our organization] for your designated purposes.

Pooled Income Fund: Your gift goes into an investment pool that functions like a mutual fund. Investment returns are paid to you or other beneficiaries for life, after which your gift is withdrawn and used to support your designated purpose at [our organization].

IF YOU DETERMINE A LIFE INCOME GIFT IS APPROPRIATE FOR YOU, YOU CAN CHOOSE

how your gift will ultimately benefit [our organization]. You may wish to designate it to a specific school or purpose meaningful to you. Or you may prefer to make your gift unrestricted so the university can use the funds according to its most significant needs. Depending on the amount of the gift, you may be able to specify whether you would like it to be an expendable fund (for current use) or an endowed fund (to last in perpetuity). You can ask that your name or the name of someone you wish to honor be associated with the gift.

| TYPE OF GIFT | MINIMUM GIFT | GENERALLY ACCEPTED ASSETS |

| Charitable Gift Annuity | $10,000 | cash or securities |

| Deferred Charitable Gift Annuity | $10,000 | cash or securities |

| Charitable Remainder Annuity Trust | $100,000 | cash or securities |

| Charitable Remainder Unitrust | $100,000 | cash, securities, or real estate |

| Pooled Income Fund | $10,000 | cash or securities (except for tax-exempt bonds) |

Charitable Gift Annuity (CGA)

In exchange for a gift to [Our Organization] agrees by contract to pay a fixed amount each year to one or two beneficiaries (the annuitants) for life. The annuity payment amount will depend on the annuitants’ ages and the value of the assets donated. [our organization] offers the rates suggested by the American Council on Gift Annuities, a national organization. Upon establishing a charitable gift annuity, you are entitled to a current charitable income tax deduction for a portion of the value of the assets given to fund the charitable gift annuity.

You may also create a deferred charitable gift annuity, taking a tax deduction in the year of the gift but delaying the first annuity payment for one or more years. This approach can offer dependable retirement income beginning at a future date.

The annuity rates are based on several factors, including the ages of the annuitants and the length of the deferral period.

Charitable gift annuities assure fixed payment for life, a portion of which may be partially tax-free. You can designate how you would like [our organization] to use the remaining value of the annuity when the annuity ends.

Charitable Remainder Annuity Trust (CRAT)

You establish transferring a CRAT by irrevocably transferring assets to a trustee, which could be [our organization], who then makes fixed annual payments to you and other beneficiaries. At the end of the trust term, the remaining assets are distributed to [our organization] for your designated purpose.

When you establish a charitable remainder annuity trust, you and the trustee agree to the annual payment amount, which must be at least 5 percent of the trust assets’ initial fair market value and is generally taxable to the beneficiaries.

This type of trust may appeal to older beneficiaries who appreciate knowing exactly how much they will receive each year and are not as concerned about the effects of inflation over time.

Charitable Remainder Unitrust (CRUT)

You establish transferring a CRUT by irrevocably transferring assets to a trustee, [our organization], who then invests the trust assets and pays you and other beneficiaries an annual variable income. At the end of the trust term, the assets remaining in the trust are distributed to [our organization] for your designated purpose. [our organization]has various options for investing the trust assets.

You can name yourself and other beneficiaries to receive income for life and for a term of up to 20 years. The amount of the annual payout depends partly on the type of unitrust.

Standard unitrusts are the most common. They provide an income based on a fixed percentage (at least 5 percent) determined when the trust is created. The percentage is multiplied by the fair market value of the trust assets at the beginning of each year to determine the payout to beneficiaries for that year.

A standard unitrust provides the most investment flexibility and is usually invested for a maximum return.

A net income unitrust provides annual payments in the lesser of two amounts:

1) the fixed percentage of the trust’s annual value described above, or 2) the net income of the trust. Younger donors who are not seeking large payments immediately but want to build a fund for potentially higher payments in the future may find this type of trust appealing.

A combination or “flip” unitrust is a good option when an illiquid, non-income-producing asset, such as real estate or closely-held stock, is used to fund a charitable remainder unitrust. The trust begins as a net income unitrust, paying the lesser of the selected payout rate or the actual earnings (for example, rents from real estate) to the income beneficiaries. As of January 1, after the date of the sale of the assets used to fund the trust, the trust “flips” to a standard unitrust. A flip unitrust can also help you plan for retirement because the flip date may be set for a date when you expect to retire.

Pooled Income Fund (PIF)

Your gift to a PIF will purchase shares of an investment tool that resembles and functions like a mutual fund. The fund’s annual income is allocated proportionately between the pooled income fund participants, depending on the number of shares they hold. You can name yourself and other beneficiaries to receive the income from the shares for life. You can designate a purpose for the value of the shares to support upon the death of the income beneficiaries of your pooled income gift.

Contact Us

If you are interested in designing a life income gift compatible with your personal needs call us. Our office can help you explore options. To learn more, please call or email us or visit our website

Those considering a planned gift should consult their own legal and tax advisors and our office is pleased to speak with your advisors.