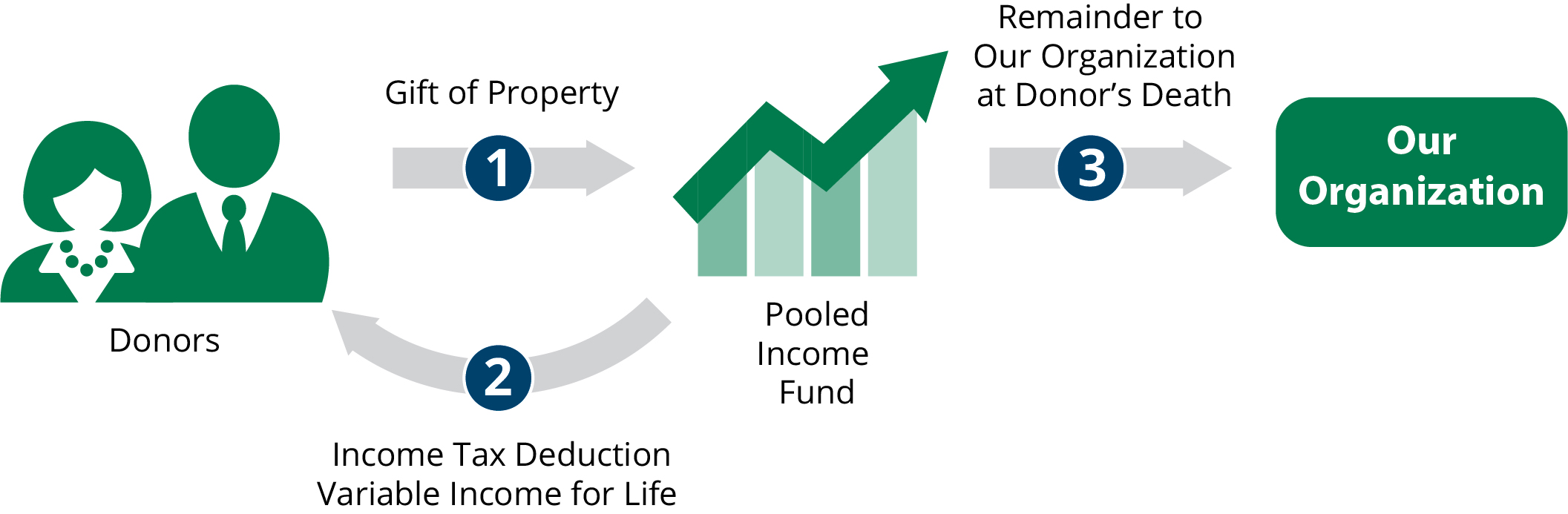

You can take care of yourself and take care of our organization by making a gift to a pooled income fund. Your gift will purchase shares of an investment pool that functions like a mutual fund.

The fund’s annual income is allocated proportionately between the pooled income fund participants, depending on the number of shares they hold. You can name yourself and other beneficiaries to receive the income from the shares for life. At the end of the income beneficiary’s life, the fund’s shares are withdrawn and used to support our organization for the purpose you designate.

Benefits

- Receive annual income

- Diversify your investments

- Federal, and possible state, income tax deduction

- Pay no immediate capital gains tax on the transfer of appreciated assets

- Make a gift to our organization

This might interest you if…

You want to make a gift to our organization and you:

- Want to receive a variable income annually for life

- Have assets that you are able to give away. Assets that work especially well include:

- Cash or funds earning low interest rates

- Appreciated securities

- Have a large part of your portfolio in one company and want to diversify your investments

- Want to reduce your current income taxes with an income tax charitable deduction

Fund options

If you make a gift to a pooled income fund at our organization, you may choose between two options that have different investment strategies:

- The our organization balanced fund seeks regular income for beneficiaries while prioritizing growth of principal for greater future income.

- The our organization long-term income fund seeks a higher rate of current income and modest long-term growth.

Please note that there is no guaranteed income from these funds since they depend on market performance.

Funding Assets

Cash or securities.

Contact us

If you are interested in learning more about our organization’s pooled income funds, please contact us. Based on your circumstances, we would be happy to provide you with information about how a pooled income fund gift would work for you.

Those considering a planned gift should consult their own legal and tax advisors. The staff in the Office of Planned Giving are happy to speak with advisors as well.

Pooled income fund example

Troy Conway, age 65, has stocks worth $100,000, which he bought for $10,000 and which pay dividends of 2 percent per year.

He would like to sell the stocks and diversify his asset base but hesitates because the federal capital gains tax would be $13,500. He is in the 35 percent income tax bracket for ordinary income and the 15 percent for federal long-term capital gains.

Suppose our organization’s Balanced Pooled Income Fund earns 2 percent (the current net payout varies; current payout rates are available on request). By making a gift of his stocks to the balanced pool, Troy will diversify his assets. In addition, he receives a charitable income tax deduction of about $56,000 (based on an IRS discount rate of 0.6 percent), saving roughly $19,600 in income tax, and he avoids $13,500 in federal capital gains tax. When Troy dies, the shares that his original gift “bought” in the pooled income fund will be withdrawn to establish a fund bearing his name to support research at our organization.